FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

Por um escritor misterioso

Last updated 22 setembro 2024

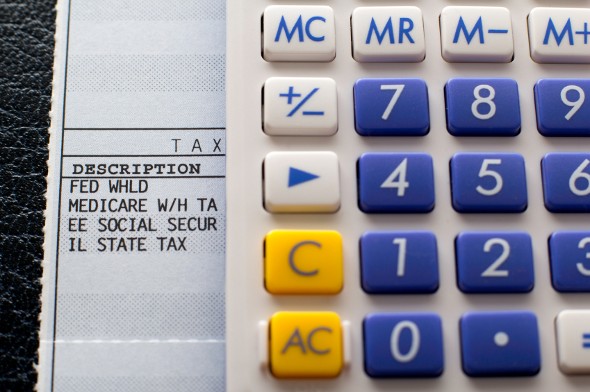

A guide to understanding the FICA tax, also called payroll tax - the mandatory deduction from your employee’s payroll. Know your FICA tax rates, exemptions, & tips

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Understanding the FICA Tax Short for the Federal Insurance Contributions Act, FICA refers to the American law that requires both employees and employers to contribute to the cost of the Social Security and Medicare programs in the US. Therefore, the FICA tax refers to the taxes paid in accordance with this law. Let’s dive deeper with this essential guide to the FICA tax. What is the FICA Tax? The FICA tax is a mandatory deduction from an employee’s payroll. American employers must withhold a

Understanding Payroll Taxes and Who Pays Them - SmartAsset

SSDI & Federal Income Tax ~ NOSSCR

What is Self-Employment Tax? (2022-23 Rates and Calculator)

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes and Employer Responsibilities

How do federal income tax rates work?

2023-2024 Tax Brackets & Federal Income Tax Rates

What are FICA Taxes? 2022-2023 Rates and Instructions

2023 Social Security Wage Base Increases to $160,200

FICA Tax: What It is and How to Calculate It

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck22 setembro 2024

What is Fica Tax?, What is Fica on My Paycheck22 setembro 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks22 setembro 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks22 setembro 2024 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?22 setembro 2024

FICA Tax Rate: What is the percentage of this tax and how you can calculated?22 setembro 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes22 setembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes22 setembro 2024 -

Overview of FICA Tax- Medicare & Social Security22 setembro 2024

Overview of FICA Tax- Medicare & Social Security22 setembro 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 setembro 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations22 setembro 2024 -

What Is FICA Tax?22 setembro 2024

What Is FICA Tax?22 setembro 2024 -

What is the FICA Tax Refund? - Boundless22 setembro 2024

What is the FICA Tax Refund? - Boundless22 setembro 2024 -

What it means: COVID-19 Deferral of Employee FICA Tax22 setembro 2024

What it means: COVID-19 Deferral of Employee FICA Tax22 setembro 2024 -

FICA Tax Tip Fairness Pro Beauty Association22 setembro 2024

FICA Tax Tip Fairness Pro Beauty Association22 setembro 2024

você pode gostar

-

Camiseta Oakley Dragon Tatto Bege | Camiseta Masculina Oakley Nunca Usado 89089151 | enjoei22 setembro 2024

-

Kyuukyoku Shinka Shita Full Dive RPG ga Genjitsu Yori mo Kusoge Dattara - Episode 6 discussion : r/anime22 setembro 2024

Kyuukyoku Shinka Shita Full Dive RPG ga Genjitsu Yori mo Kusoge Dattara - Episode 6 discussion : r/anime22 setembro 2024 -

What Even is Tomo-chan is a Girl?22 setembro 2024

What Even is Tomo-chan is a Girl?22 setembro 2024 -

Bebê Conforto Com Boneca La New Reborn Infantil - Cotiplás 184822 setembro 2024

Bebê Conforto Com Boneca La New Reborn Infantil - Cotiplás 184822 setembro 2024 -

Jogo Bingo Hasbro Gaming - Fátima Criança22 setembro 2024

Jogo Bingo Hasbro Gaming - Fátima Criança22 setembro 2024 -

Record TV exibe matéria acusando Death Note de ser violento para22 setembro 2024

Record TV exibe matéria acusando Death Note de ser violento para22 setembro 2024 -

Rorschach22 setembro 2024

Rorschach22 setembro 2024 -

Naruto KMC(Naruto) VS Katakuri(One Piece)22 setembro 2024

Naruto KMC(Naruto) VS Katakuri(One Piece)22 setembro 2024 -

Saiba como funciona o sistema de Matchmaking, Status Prime e não-ranqueadas do CS:GO22 setembro 2024

Saiba como funciona o sistema de Matchmaking, Status Prime e não-ranqueadas do CS:GO22 setembro 2024 -

Dinossauros Bonitos Do Bebê Em Chapéus De Festa Que Dão O Jogo Dos Presentes, Caráteres Engraçados Adoráveis Do Dinossauro Que Guardam Caixas De Presente, Animais Felizes Que Celebram A Ilustração Do Vetor22 setembro 2024

Dinossauros Bonitos Do Bebê Em Chapéus De Festa Que Dão O Jogo Dos Presentes, Caráteres Engraçados Adoráveis Do Dinossauro Que Guardam Caixas De Presente, Animais Felizes Que Celebram A Ilustração Do Vetor22 setembro 2024