Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 22 setembro 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

What Is FICA on a Paycheck? FICA Tax Explained - Chime

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023)

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

fica tax - FasterCapital

Maximum Taxable Income Amount For Social Security Tax (FICA)

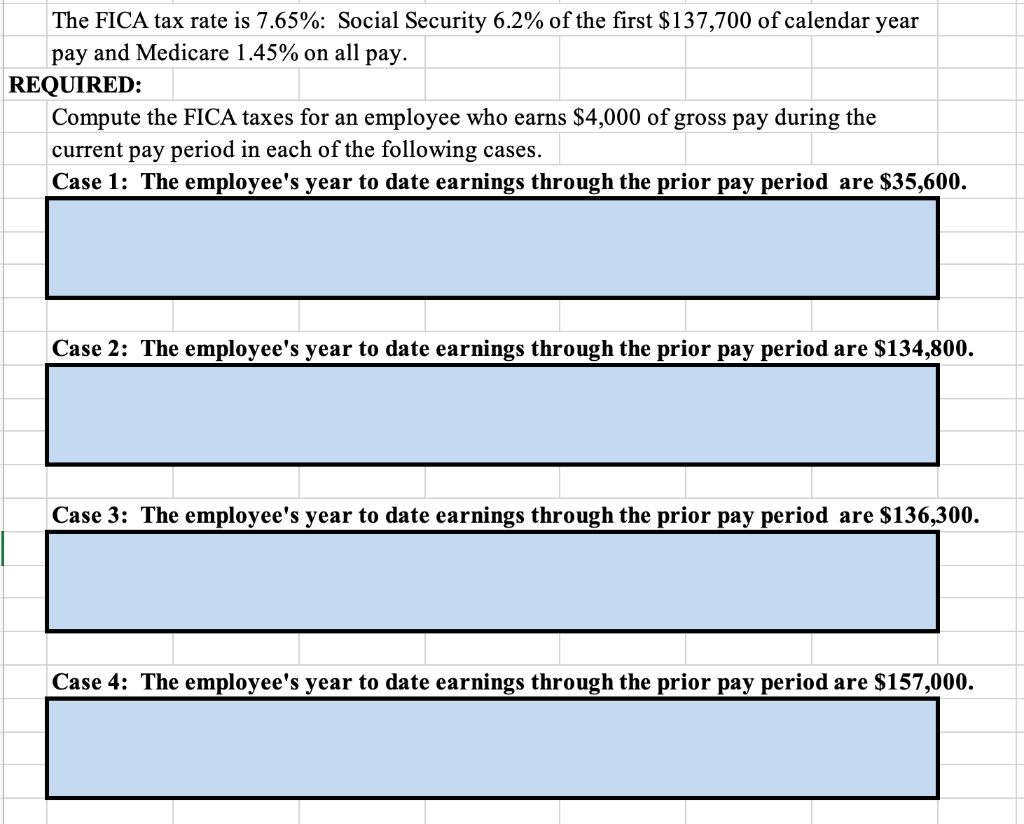

Solved The FICA tax rate is 7.65%: Social Security 6.2% of

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

Social Security Administration Announces 2022 Payroll Tax Increase

FICA tax rate 2022: How can you adjust you Social Security and

Recomendado para você

-

FICA Tax: What It is and How to Calculate It22 setembro 2024

FICA Tax: What It is and How to Calculate It22 setembro 2024 -

What is the FICA Tax and How Does it Connect to Social Security?22 setembro 2024

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?22 setembro 2024

Why Is There a Cap on the FICA Tax?22 setembro 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 setembro 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 setembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know22 setembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know22 setembro 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and22 setembro 2024

-

What Are FICA Taxes And Why Do They Matter? - Quikaid22 setembro 2024

What Are FICA Taxes And Why Do They Matter? - Quikaid22 setembro 2024 -

Vola22 setembro 2024

Vola22 setembro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 setembro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine22 setembro 2024 -

2019 US Tax Season in Numbers for Sprintax Customers22 setembro 2024

2019 US Tax Season in Numbers for Sprintax Customers22 setembro 2024

você pode gostar

-

Silver Plated Bubble Drop Stud Earrings - Lovisa22 setembro 2024

Silver Plated Bubble Drop Stud Earrings - Lovisa22 setembro 2024 -

Boku no Hero Academia – Filme americano será feito pelo diretor do22 setembro 2024

Boku no Hero Academia – Filme americano será feito pelo diretor do22 setembro 2024 -

One Piece Cast Answer 50 of the Most Googled Questions About the22 setembro 2024

One Piece Cast Answer 50 of the Most Googled Questions About the22 setembro 2024 -

Mahoutsukai no Yome será exibido em cinema dublado - Anime United22 setembro 2024

Mahoutsukai no Yome será exibido em cinema dublado - Anime United22 setembro 2024 -

Ensaio Namorando - Camila & Bruno - Patos de Minas - MG22 setembro 2024

Ensaio Namorando - Camila & Bruno - Patos de Minas - MG22 setembro 2024 -

Heroman - Wikipedia22 setembro 2024

Heroman - Wikipedia22 setembro 2024 -

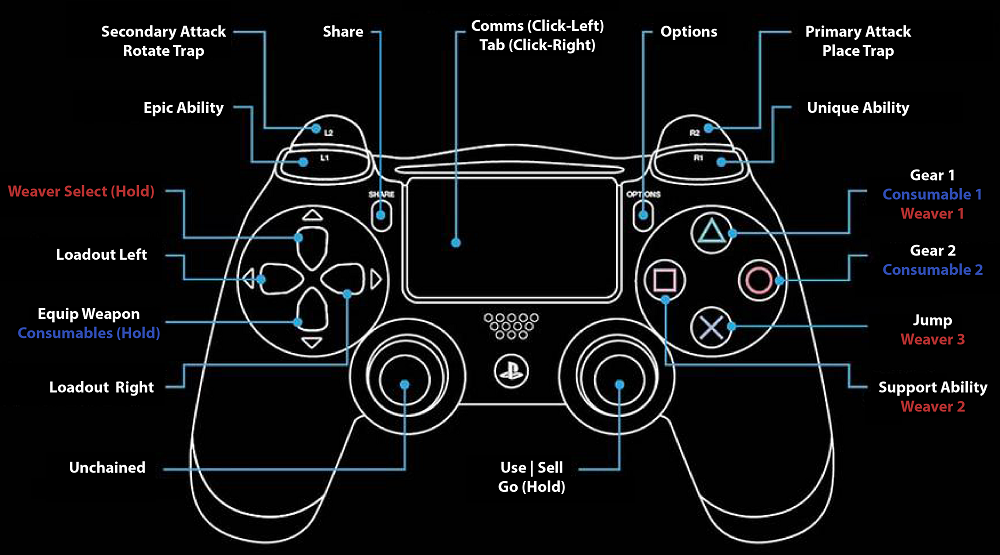

GTA 5 PS4 Mods incl Mod Menu Free Download 2023 - Decidel22 setembro 2024

GTA 5 PS4 Mods incl Mod Menu Free Download 2023 - Decidel22 setembro 2024 -

Como jogar ONLINE no XBOX 360 RGH e JTAG22 setembro 2024

Como jogar ONLINE no XBOX 360 RGH e JTAG22 setembro 2024 -

ALL *2022 NEW YEARS* SECRET Roblox PROMO CODES!22 setembro 2024

ALL *2022 NEW YEARS* SECRET Roblox PROMO CODES!22 setembro 2024 -

Karina Kanzler Ferreira é campeã feminina do Aberto de Xadrez em São Paulo22 setembro 2024

Karina Kanzler Ferreira é campeã feminina do Aberto de Xadrez em São Paulo22 setembro 2024