FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Last updated 21 setembro 2024

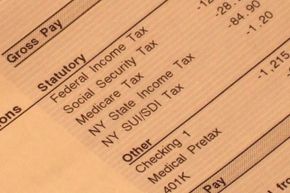

Both employees and employers are required to pay FICA tax, which is withheld from an employee

2021 Wage Cap Rises for Social Security Payroll Taxes

Maximum Taxable Income Amount For Social Security Tax (FICA)

FICA Tax: Understanding Social Security and Medicare Taxes

What is FICA tax?

What Is FICA on a Paycheck? FICA Tax Explained - Chime

2019 Payroll Taxes Will Hit Higher Incomes

Understanding FICA, Medicare, and Social Security Tax

FICA Tax & Who Pays It

What Are FICA Taxes? – Forbes Advisor

What Is FICA Tax? A Complete Guide for Small Businesses

Maximum Taxable Income Amount For Social Security Tax (FICA)

FICA Tax Rate: What is the percentage of this tax and how you can calculated?

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

The FICA Tax: How Social Security Is Funded – Social Security Intelligence

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions21 setembro 2024

-

What is FICA tax?21 setembro 2024

What is FICA tax?21 setembro 2024 -

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes21 setembro 2024

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes21 setembro 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers21 setembro 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers21 setembro 2024 -

Employee Social Security Tax Deferral Repayment21 setembro 2024

Employee Social Security Tax Deferral Repayment21 setembro 2024 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet21 setembro 2024

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet21 setembro 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime21 setembro 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime21 setembro 2024 -

FICA explained: Social Security and Medicare tax rates to know in 202321 setembro 2024

FICA explained: Social Security and Medicare tax rates to know in 202321 setembro 2024 -

What Eliminating FICA Tax Means for Your Retirement21 setembro 2024

-

FICA Tax Tip Fairness Pro Beauty Association21 setembro 2024

FICA Tax Tip Fairness Pro Beauty Association21 setembro 2024

você pode gostar

-

comentem por favor #foryou #ttk #fpy #2022tiktok #cria #mandrake #robl21 setembro 2024

-

Jogo de quebra-cabeça dragão grátis::Appstore for Android21 setembro 2024

Jogo de quebra-cabeça dragão grátis::Appstore for Android21 setembro 2024 -

COMPRA E VENDA DE CONSÓRCIOS - IMÓVEIS, CARROS, MOTOS, SERVIÇOS21 setembro 2024

-

336 Slovenian Mountain Trail Stock Photos - Free & Royalty-Free Stock Photos from Dreamstime21 setembro 2024

336 Slovenian Mountain Trail Stock Photos - Free & Royalty-Free Stock Photos from Dreamstime21 setembro 2024 -

VOLKSWAGEN SAVEIRO CROSS 1.6 T. FLEX 16V CE 2017 - 120703315621 setembro 2024

VOLKSWAGEN SAVEIRO CROSS 1.6 T. FLEX 16V CE 2017 - 120703315621 setembro 2024 -

Animes completos21 setembro 2024

Animes completos21 setembro 2024 -

Conheça os DUBLADORES de DEMON SLAYER (Kimetsu no Yaiba) no Brasil21 setembro 2024

Conheça os DUBLADORES de DEMON SLAYER (Kimetsu no Yaiba) no Brasil21 setembro 2024 -

NEW Lego BLUE MOON ICE CREAM w/Gold Cup - Friends Minifig Sundae Kitchen Food21 setembro 2024

NEW Lego BLUE MOON ICE CREAM w/Gold Cup - Friends Minifig Sundae Kitchen Food21 setembro 2024 -

Jogo de Damas e Ludo Junges Branco21 setembro 2024

Jogo de Damas e Ludo Junges Branco21 setembro 2024 -

Mairimashita! Iruma-kun 2nd Season – 06 - Lost in Anime21 setembro 2024

Mairimashita! Iruma-kun 2nd Season – 06 - Lost in Anime21 setembro 2024