FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Por um escritor misterioso

Last updated 11 novembro 2024

Employers and employees must pay FICA taxes to contribute to social security and medicare. What you need to know.

FICA Tax: Rates, How It Works in 2023-2024 - NerdWallet

What are the major federal payroll taxes, and how much money do they raise?

What is a 401(k) Plan? - NerdWallet

Payroll Deductions: The Ultimate Guide for Business Owners - NerdWallet

Self-Employed Retirement Plans: Know Your Options - NerdWallet

50/30/20 Budget Calculator - NerdWallet

The ABCs of FICA: Federal Insurance Contributions Act Explained - FasterCapital

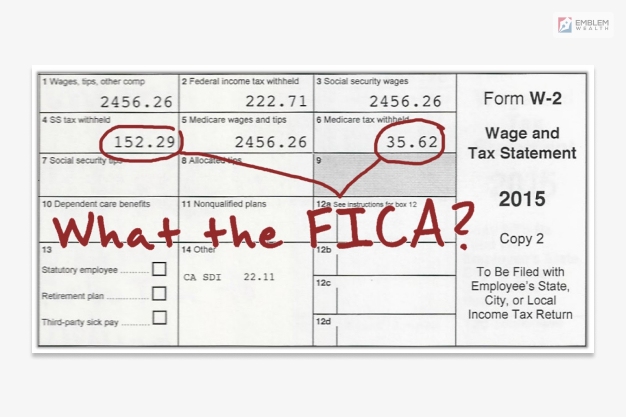

What Is FICA On My Paycheck? What Is FICA Tax?

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes and Employer Responsibilities

What Is FICA Tax: How It Works And Why You Pay

What are the major federal payroll taxes, and how much money do they raise?

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog11 novembro 2024

What is FICA Tax? - The TurboTax Blog11 novembro 2024 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)11 novembro 2024

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)11 novembro 2024 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents11 novembro 2024

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents11 novembro 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know11 novembro 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know11 novembro 2024 -

What Is FICA Tax? —11 novembro 2024

What Is FICA Tax? —11 novembro 2024 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com11 novembro 2024

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com11 novembro 2024 -

2017 FICA Tax: What You Need to Know11 novembro 2024

2017 FICA Tax: What You Need to Know11 novembro 2024 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books11 novembro 2024

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books11 novembro 2024 -

FICA TAX PROVISIONS (1967-1980)11 novembro 2024

FICA TAX PROVISIONS (1967-1980)11 novembro 2024 -

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?11 novembro 2024

What is FICA and How To Calculate FICA Tax 2023 With Complete Guide?11 novembro 2024

você pode gostar

-

Dragon Quest Monsters: novo game é anunciado para Nintendo Switch11 novembro 2024

Dragon Quest Monsters: novo game é anunciado para Nintendo Switch11 novembro 2024 -

Deaimon Season 2: When To Expect? Story Revealed - OtakuKart11 novembro 2024

Deaimon Season 2: When To Expect? Story Revealed - OtakuKart11 novembro 2024 -

Wim Hof Breathing: Unveiling Technique, Benefits and Safety11 novembro 2024

Wim Hof Breathing: Unveiling Technique, Benefits and Safety11 novembro 2024 -

Play Sonic: The Hedgehog 4 for free without downloads11 novembro 2024

Play Sonic: The Hedgehog 4 for free without downloads11 novembro 2024 -

Mahjong 12 niveles - juega Mahjong gratis pantalla completa!11 novembro 2024

Mahjong 12 niveles - juega Mahjong gratis pantalla completa!11 novembro 2024 -

Championship Logos - 66+ Best Championship Logo Ideas. Free11 novembro 2024

-

Download Heroic Battle with the Ender Dragon Wallpaper11 novembro 2024

Download Heroic Battle with the Ender Dragon Wallpaper11 novembro 2024 -

Android Game Mod-Hacks - [Update] Angry Birds Epic v1.3.0 1. Infinite Coins 2. Infinite Snoutlings 3. Infinite Friendship Credit: hokage242 วิธีลง - Installing - ดาวโหลดมาทั้งไฟล์ Apk และ Obb - แตกไฟล์ Data Obb (11 novembro 2024

-

Adachi to Shimamura Chapter 15 Discussion - Forums11 novembro 2024

-

Birds of Prey in Scotland — Blog — the SCOTTISH countryman11 novembro 2024

Birds of Prey in Scotland — Blog — the SCOTTISH countryman11 novembro 2024

![Android Game Mod-Hacks - [Update] Angry Birds Epic v1.3.0 1. Infinite Coins 2. Infinite Snoutlings 3. Infinite Friendship Credit: hokage242 วิธีลง - Installing - ดาวโหลดมาทั้งไฟล์ Apk และ Obb - แตกไฟล์ Data Obb (](https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=1564712247117421)