How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Last updated 10 novembro 2024

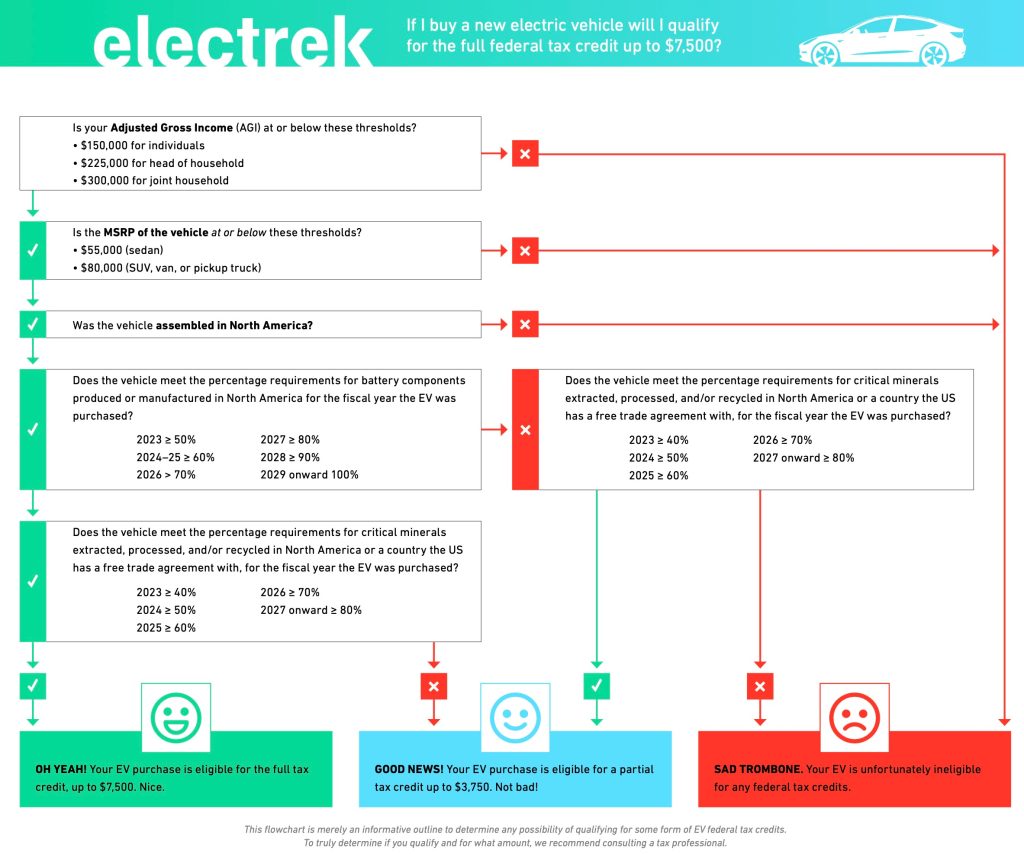

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

Here are the cars eligible for the $7,500 EV tax credit in the Inflation Reduction Act in 2023

What to know about the $7,500 IRS EV tax credit for electric cars in 2023 : NPR

How Do the Electric Vehicle Tax Credits Work?

What to know about the $7,500 IRS EV tax credit for electric cars in 2023 : NPR

Commercial Clean Vehicle Credit: What You Need to Know - Withum

The easiest way to get a $7,500 tax credit for an electric vehicle? Consider leasing.

Clean Vehicle Tax Credit

Understanding the New Clean Vehicle Credit - TurboTax Tax Tips & Videos

How to claim a $7,500 EV tax credit: What to know about 2023 IRL rules

Clean vehicle tax credit: The new industrial policy and its impact

Recomendado para você

-

EVS Work - Branco » Voltz Motors10 novembro 2024

EVS Work - Branco » Voltz Motors10 novembro 2024 -

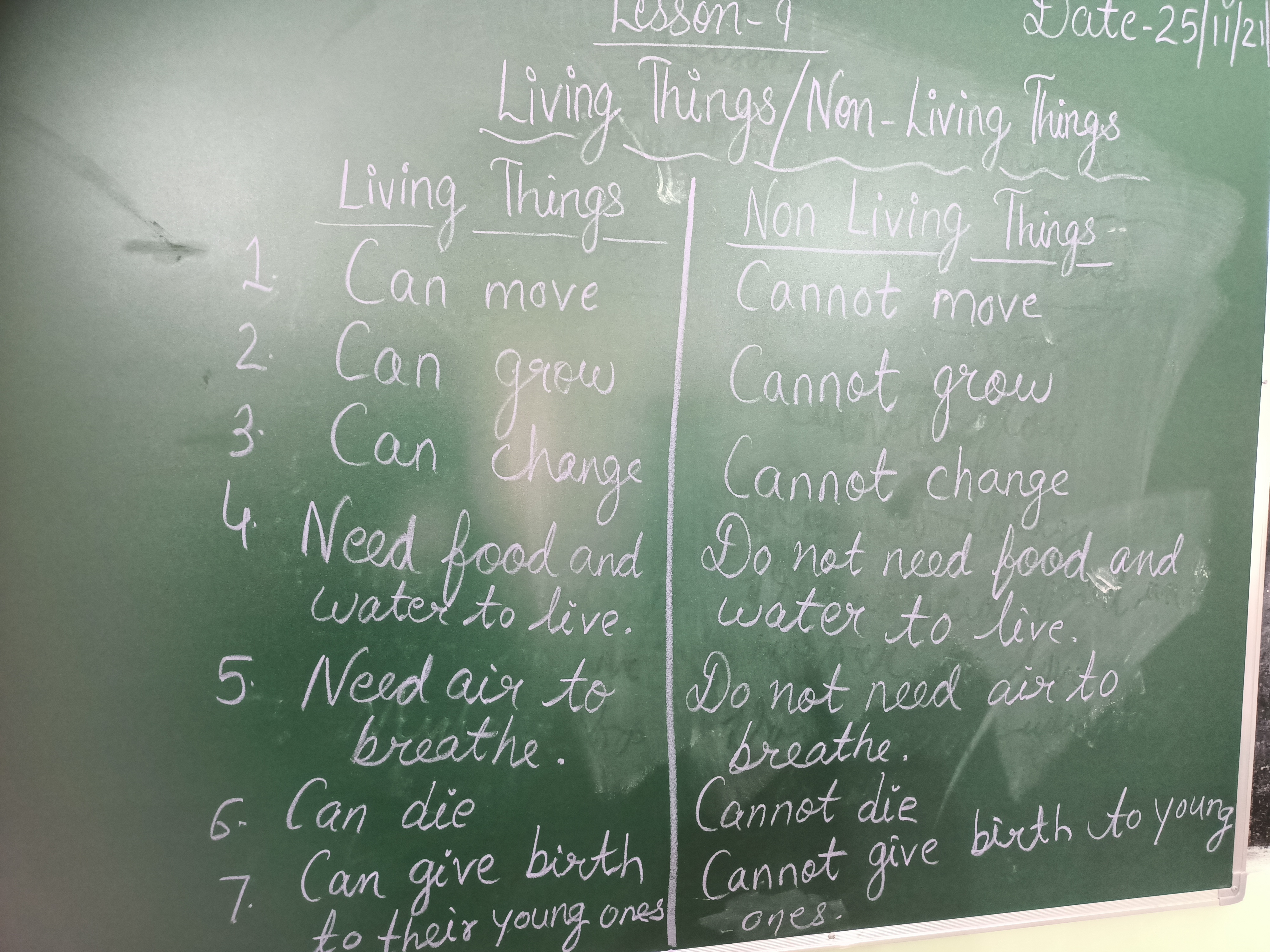

EVS Work - All Subjects - Notes - Teachmint10 novembro 2024

EVS Work - All Subjects - Notes - Teachmint10 novembro 2024 -

Evs Home Work - EVS - Notes - Teachmint10 novembro 2024

Evs Home Work - EVS - Notes - Teachmint10 novembro 2024 -

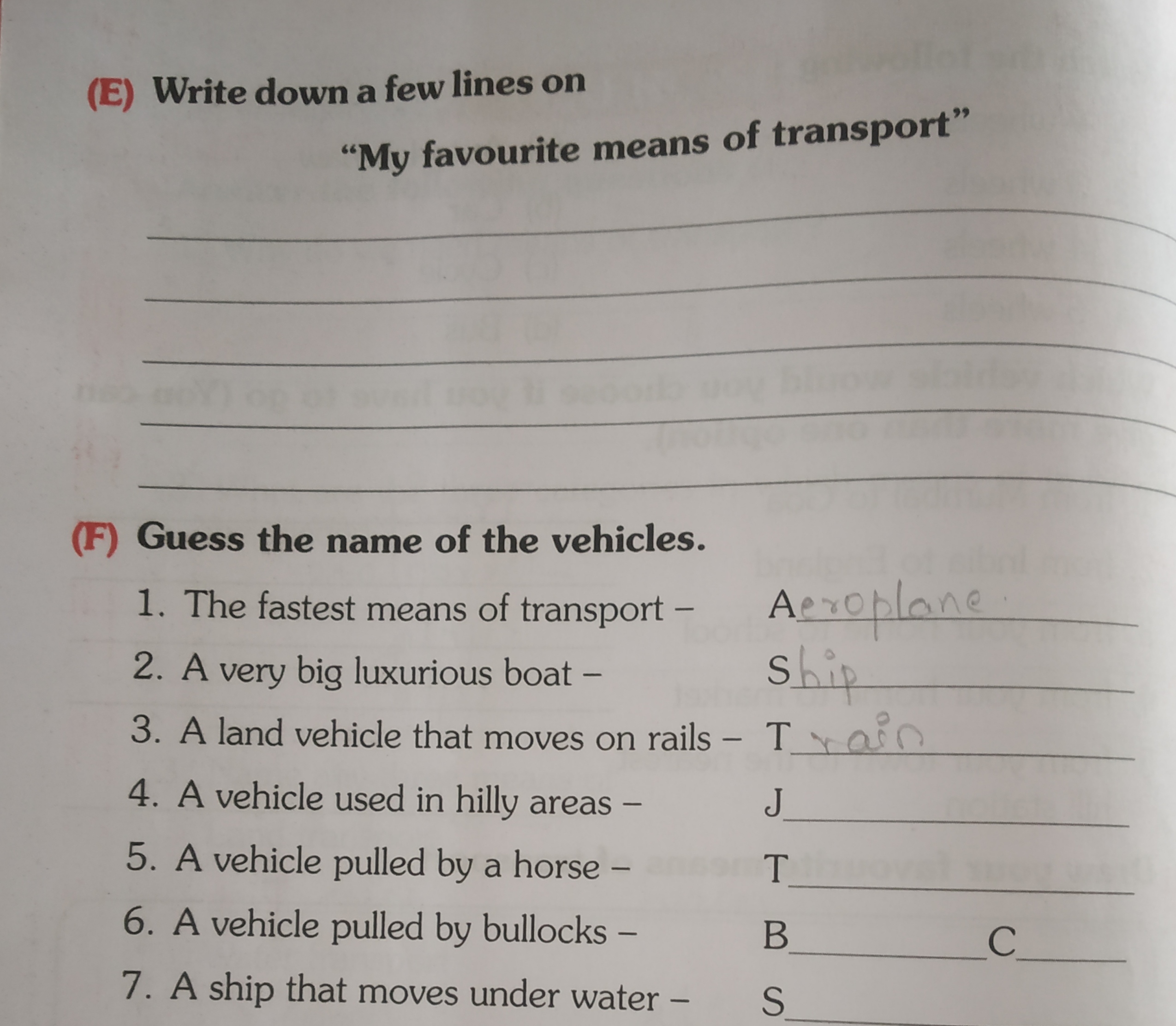

WORKSHEET / work We Do / Class-3 EVS10 novembro 2024

WORKSHEET / work We Do / Class-3 EVS10 novembro 2024 -

What are EVs (Electric Vehicles)?10 novembro 2024

-

Free EVS Work sheet for Nursery Kids ll Kindergarten learning ll Sai learning world Channel - YouT… in 202310 novembro 2024

Free EVS Work sheet for Nursery Kids ll Kindergarten learning ll Sai learning world Channel - YouT… in 202310 novembro 2024 -

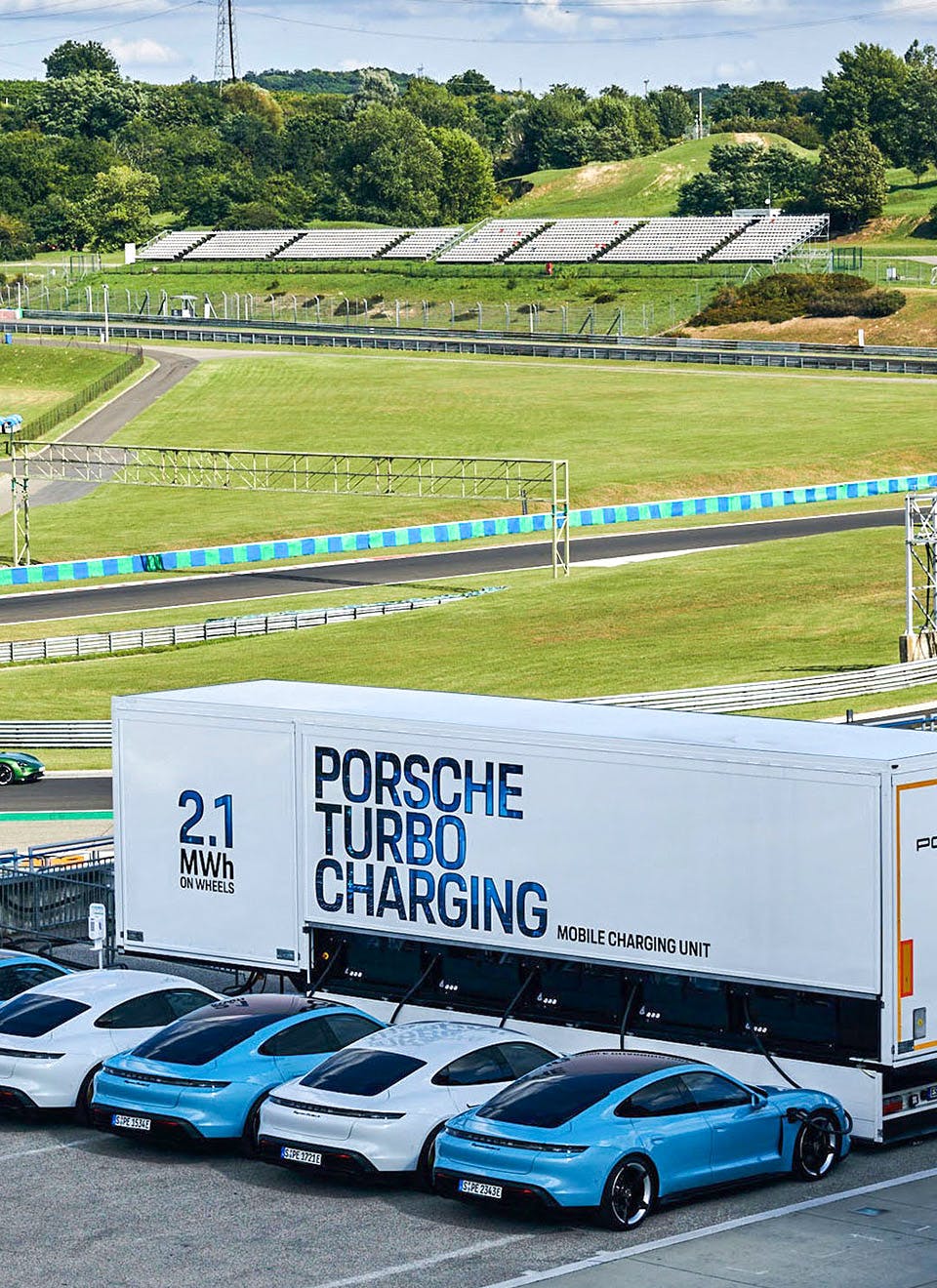

What is the Porsche Turbo Charging trailer?10 novembro 2024

-

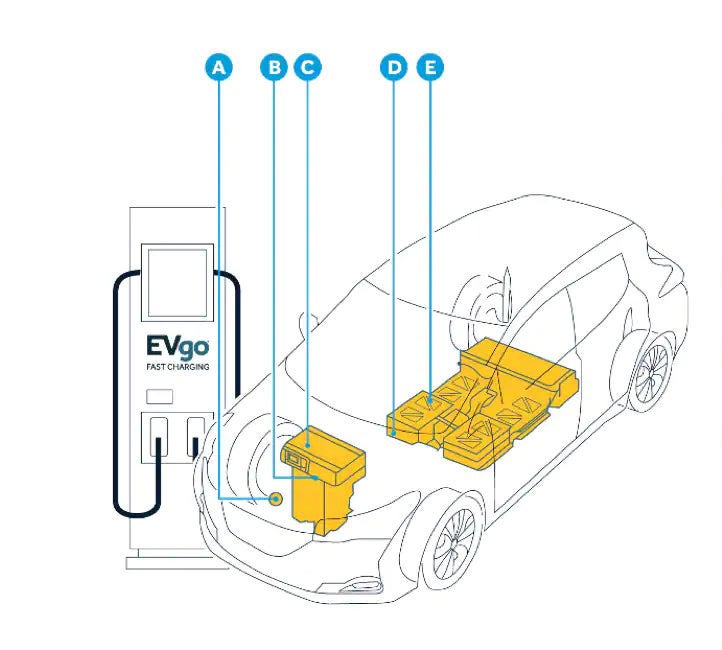

How Do EVs Work?10 novembro 2024

How Do EVs Work?10 novembro 2024 -

The answer to making your EVs work harder is here - Smartrak10 novembro 2024

The answer to making your EVs work harder is here - Smartrak10 novembro 2024 -

DriveItAway partners with Perks at Work to offer path to EVs for Fortune 1000 companies Auto Remarketing Auto Fin Journal - Business Intelligence for Automotive and Auto FinTech Executives10 novembro 2024

DriveItAway partners with Perks at Work to offer path to EVs for Fortune 1000 companies Auto Remarketing Auto Fin Journal - Business Intelligence for Automotive and Auto FinTech Executives10 novembro 2024

você pode gostar

-

Reviews: Wrath of the Titans - IMDb10 novembro 2024

Reviews: Wrath of the Titans - IMDb10 novembro 2024 -

Quando Chama o Coração substitui ator em nova temporada10 novembro 2024

Quando Chama o Coração substitui ator em nova temporada10 novembro 2024 -

Metal Gear 2: Solid Snake South Base 1F Map for MSX by Rackvin10 novembro 2024

-

sem dúvidas o melhor anime da temporada #kage #kagenojitsuryokushanina10 novembro 2024

-

Quem é o PRIMEIRO JOGADOR do ROBLOX? #roblox#robloxfyp#robloxcuriosida10 novembro 2024

-

MaisPB • Fifa confirma antecipação da abertura da Copa do Mundo em novembro10 novembro 2024

MaisPB • Fifa confirma antecipação da abertura da Copa do Mundo em novembro10 novembro 2024 -

Happy Wheels10 novembro 2024

Happy Wheels10 novembro 2024 -

Buy shijou saikyou no deshi kenichi - 133325, Premium Anime Poster10 novembro 2024

Buy shijou saikyou no deshi kenichi - 133325, Premium Anime Poster10 novembro 2024 -

Attack on Titan (2015)10 novembro 2024

Attack on Titan (2015)10 novembro 2024 -

FC Mobile LIVE - EP. 25: Gameplay Deep Dive + Regions News!10 novembro 2024

FC Mobile LIVE - EP. 25: Gameplay Deep Dive + Regions News!10 novembro 2024