Bona Fide Residence test explained for US expats - 1040 Abroad

Por um escritor misterioso

Last updated 25 setembro 2024

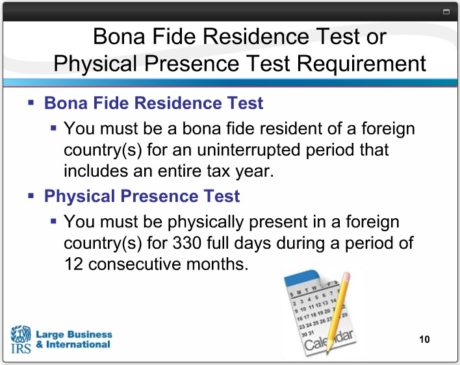

How can US expat qualify for the Foreign Earned Income exclusion? Passing Bona Fide Residence Test and meeting its requirements explained in tax infographic.

21 Things to Know About US Expat Taxes in 2022 - MyExpatTaxes

What U.S. Expats Should Know About The FEIE

Bona Fide Residence test for U.S. expats explained, by 1040 Abroad

Foreign Tax Credit and Foreign Earned Income Exclusion - BNC Tax

EXPAT TAX TIPS ON THE FOREIGN EARNED INCOME EXCLUSION - Expat Tax Professionals

IRS Form 2555 and the Foreign Earned Income Exclusion - A Practical Guide (for 2022) • Cartagena Explorer

The Bona Fide Residence Test For Expats

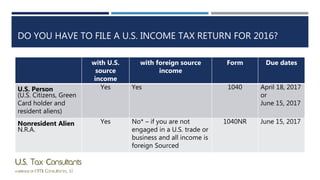

Overseas filing for us taxpayers 2017

Filing Requirements of Americans Abroad — Genesis Tax Consultants, LLC

What is the IRS Form 2555?

How to Report Foreign Income - Optima Tax Relief

Bona Fide Residence Test for Expats - MyExpatTaxes

Foreign Earned Income Exclusion: Bona Fide Vs Physical Presence Test - Universal Tax Professionals

Recomendado para você

-

When is the FIDE Chess World Cup and what is the prize fund?25 setembro 2024

When is the FIDE Chess World Cup and what is the prize fund?25 setembro 2024 -

FIDE World Junior Chess Championship “México 2023” OPEN • Round 1125 setembro 2024

FIDE World Junior Chess Championship “México 2023” OPEN • Round 1125 setembro 2024 -

Fide Partners25 setembro 2024

-

FIDE HOTEL - Updated 2023 Prices & Reviews (Istanbul, Turkiye)25 setembro 2024

FIDE HOTEL - Updated 2023 Prices & Reviews (Istanbul, Turkiye)25 setembro 2024 -

Fide soup (Fithe soup) (Σούπα φιδέ) - Mia Kouppa25 setembro 2024

Fide soup (Fithe soup) (Σούπα φιδέ) - Mia Kouppa25 setembro 2024 -

Official FIDE chess set25 setembro 2024

Official FIDE chess set25 setembro 2024 -

FIDE Online Arena (@FideOnlineArena) / X25 setembro 2024

FIDE Online Arena (@FideOnlineArena) / X25 setembro 2024 -

FIDE World Cup 1.2: 80 players out, 28 tiebreaks25 setembro 2024

FIDE World Cup 1.2: 80 players out, 28 tiebreaks25 setembro 2024 -

Where to Watch R Praggnanandhaa vs Magnus Carlsen Chess FIDE World25 setembro 2024

Where to Watch R Praggnanandhaa vs Magnus Carlsen Chess FIDE World25 setembro 2024 -

FIDE Chess Set by BeardedJester, Download free STL model25 setembro 2024

FIDE Chess Set by BeardedJester, Download free STL model25 setembro 2024

você pode gostar

-

MEGA CAT PROJECT ONE PIECE Nyan Piece Meow! Luffy & the Seven Warlords25 setembro 2024

MEGA CAT PROJECT ONE PIECE Nyan Piece Meow! Luffy & the Seven Warlords25 setembro 2024 -

DANNI CARLOS - COISAS QUE EU SEI25 setembro 2024

DANNI CARLOS - COISAS QUE EU SEI25 setembro 2024 -

Calibur, Sword Art Online Wiki25 setembro 2024

Calibur, Sword Art Online Wiki25 setembro 2024 -

4 characters Kakashi can never beat in Naruto (and 4 he easily can)25 setembro 2024

4 characters Kakashi can never beat in Naruto (and 4 he easily can)25 setembro 2024 -

Kratos vs Thor: Who wins in God of War Ragnarok's clash of titans25 setembro 2024

Kratos vs Thor: Who wins in God of War Ragnarok's clash of titans25 setembro 2024 -

LEGO Harry Potter: The Chamber of Secrets (4730) for sale online25 setembro 2024

LEGO Harry Potter: The Chamber of Secrets (4730) for sale online25 setembro 2024 -

Monster Girl Doctor (Anime) –25 setembro 2024

Monster Girl Doctor (Anime) –25 setembro 2024 -

Resident Evil: The Final Chapter' Japanese Teaser Trailer25 setembro 2024

Resident Evil: The Final Chapter' Japanese Teaser Trailer25 setembro 2024 -

The Raised Eyebrow. I never thought I'd see an Elayaraja…, by Ashwin Gopi, The Coffeelicious25 setembro 2024

The Raised Eyebrow. I never thought I'd see an Elayaraja…, by Ashwin Gopi, The Coffeelicious25 setembro 2024 -

Jump Assemble 10 Redeem Codes Claim Free Rewards Now25 setembro 2024

Jump Assemble 10 Redeem Codes Claim Free Rewards Now25 setembro 2024