Companies With 15-Plus Years of Dividend Growth

Por um escritor misterioso

Last updated 11 novembro 2024

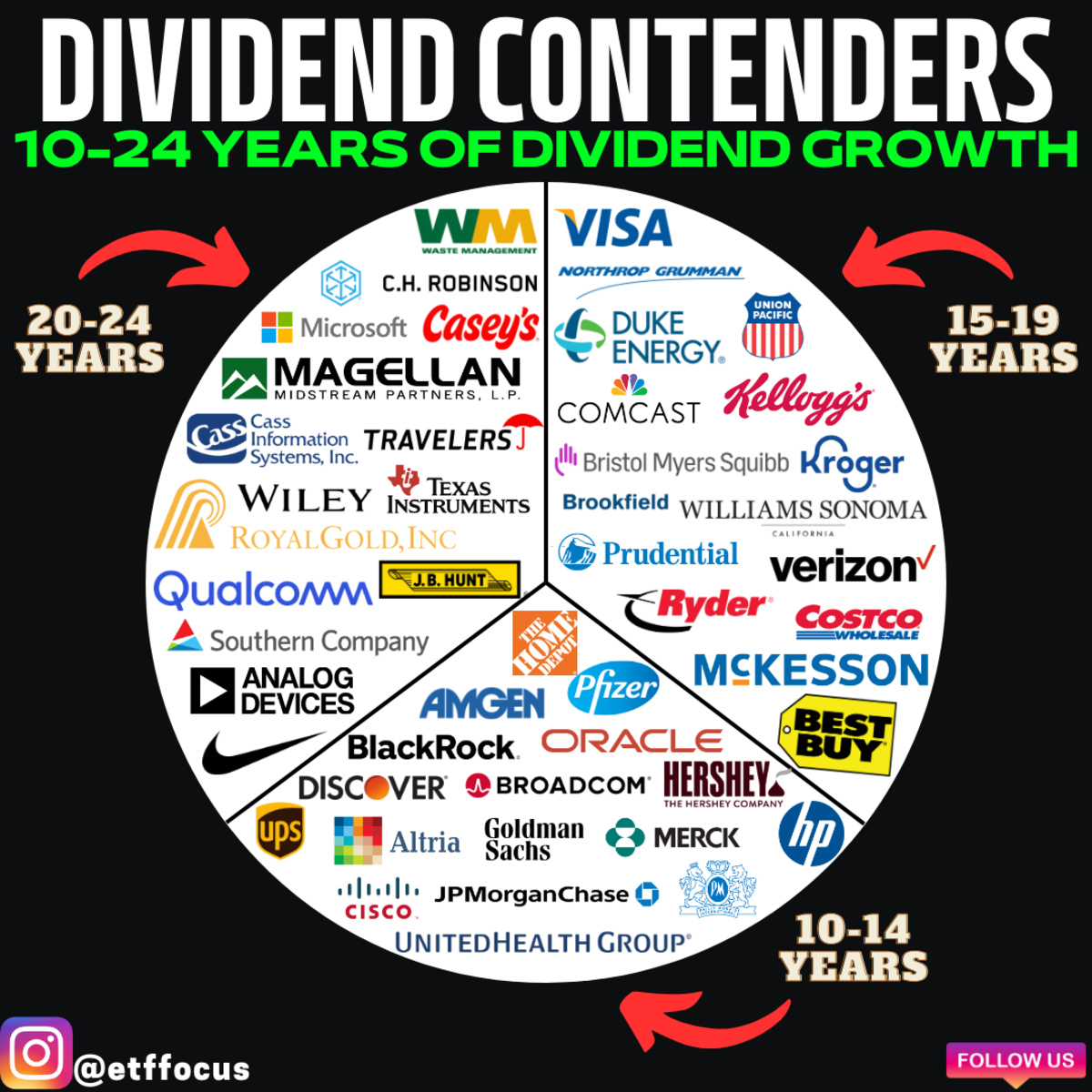

Investors are reassured – and companies consider it a point of pride – when executives note an uninterrupted track record for raising dividends. Dividend payments also offer investors a cushion on their investment, increasing the overall returns of the stock. Historically, dividend payments have accounted for more than 40 percent of the S&P 500’s total returns. Here are the top companies with 15 years or more of consecutive dividend increases.

Dividend Contenders: Why Not Get Dividend Growth AND Capital Appreciation? - ETF Focus on TheStreet: ETF research and Trade Ideas

Dividend-Paying Stocks Draw Investors - WSJ

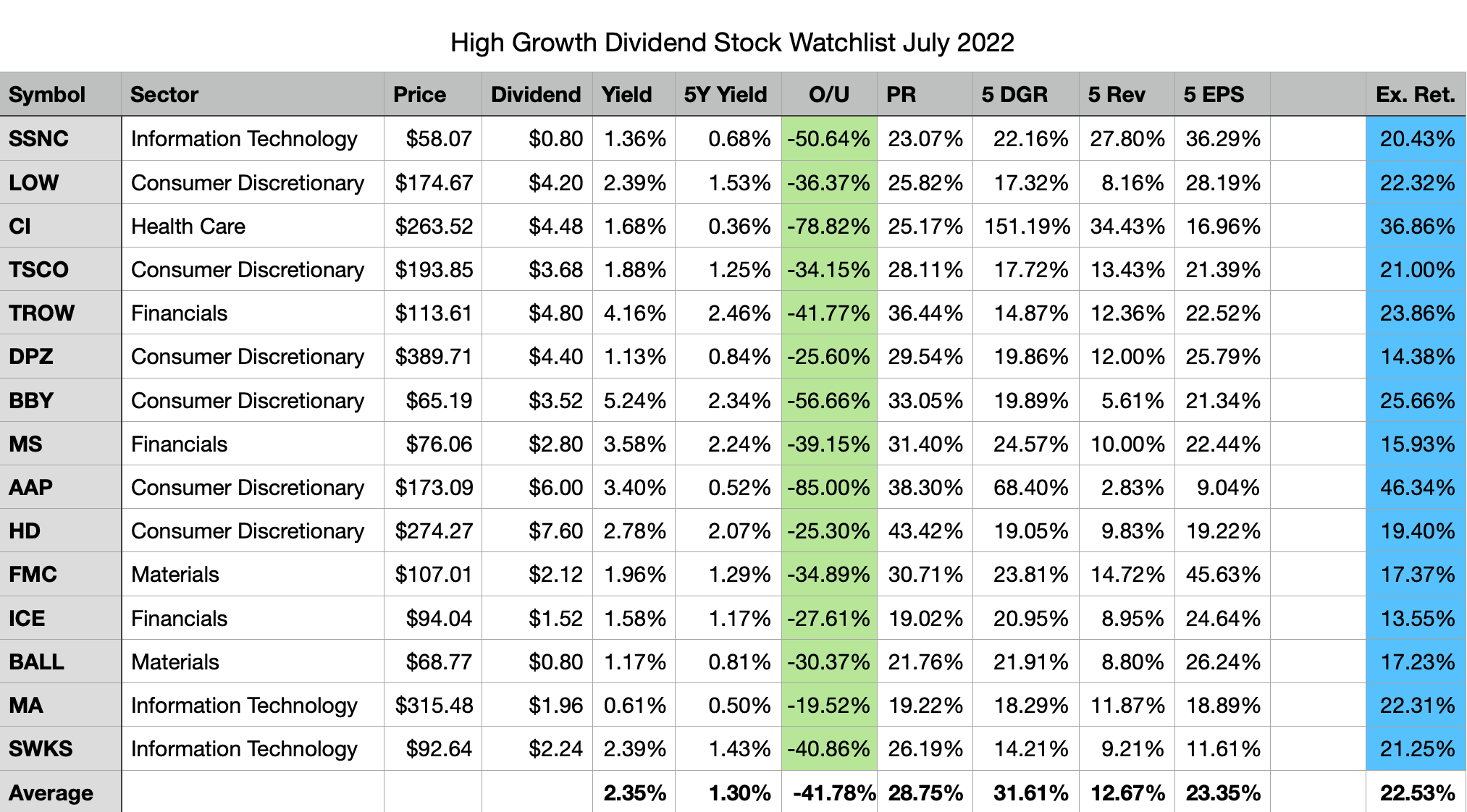

My Top 15 High Growth Dividend Stocks For July 2022

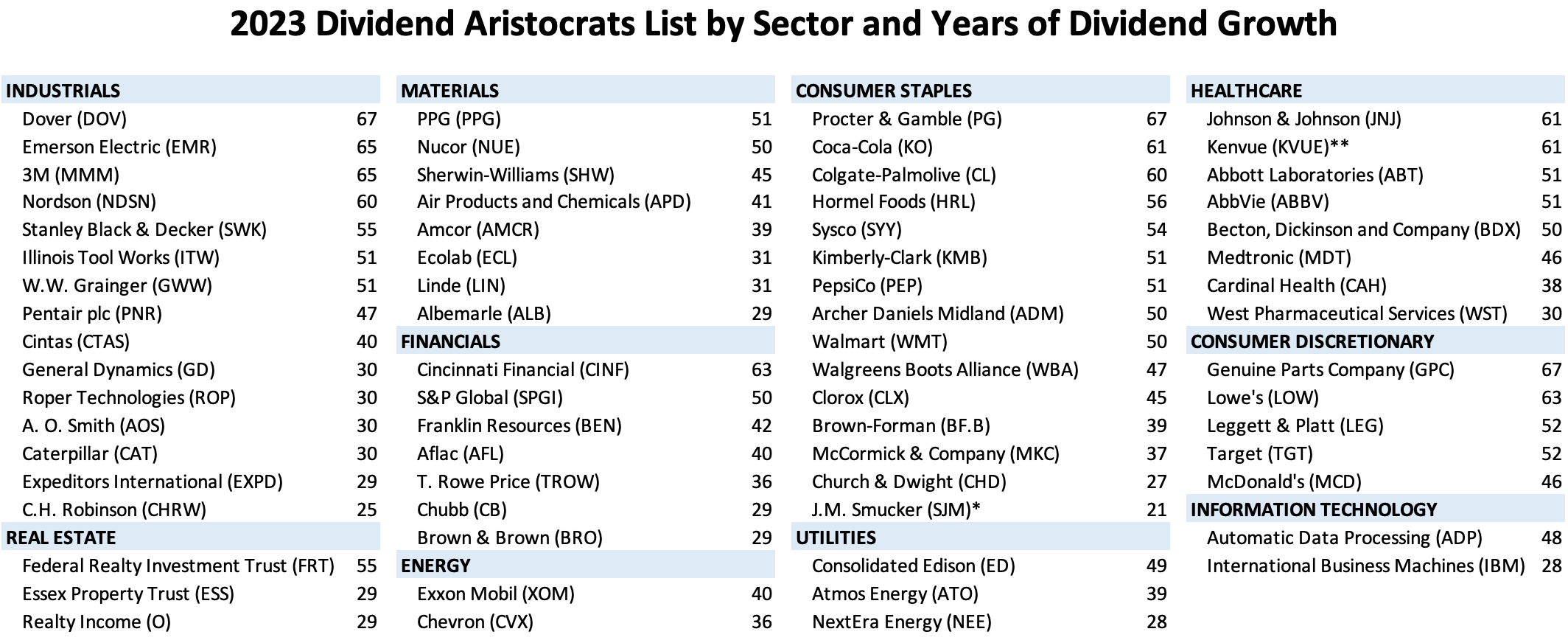

The Dividend Aristocrats List Features 65 Stocks With 25-Plus Years of Consecutive Payout Increases

The Power of Dividends: Past, Present, and Future

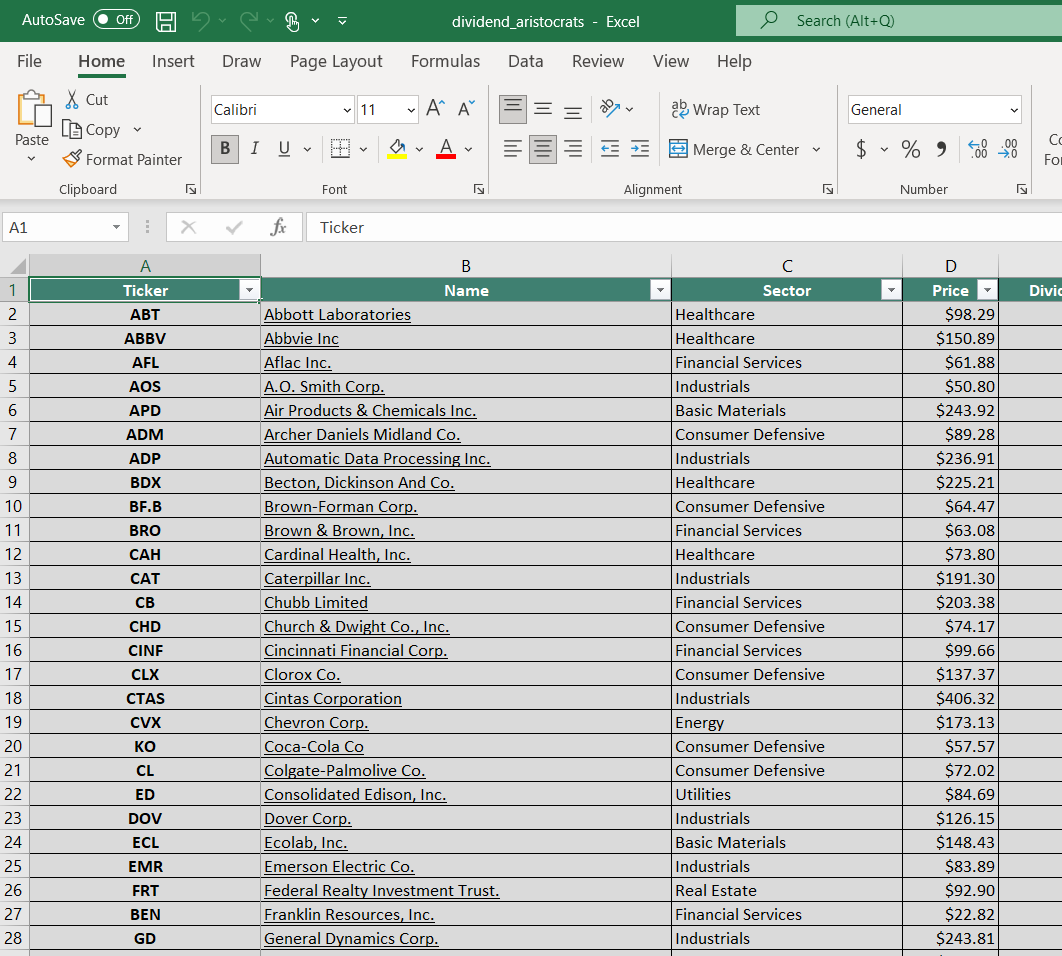

2023 Dividend Aristocrats List: All 68 + Our Top 5 Picks

Companies With 15-Plus Years of Dividend Growth

12 Best Dividend Growth Stocks For 2023 And Beyond

3 Stocks With 5%+ Yields And 15 Years Of Dividend Growth

67 Best Dividend Stocks for Dependable Dividend Growth

2023 Dividend Aristocrats List: All 68 + Our Top 5 Picks

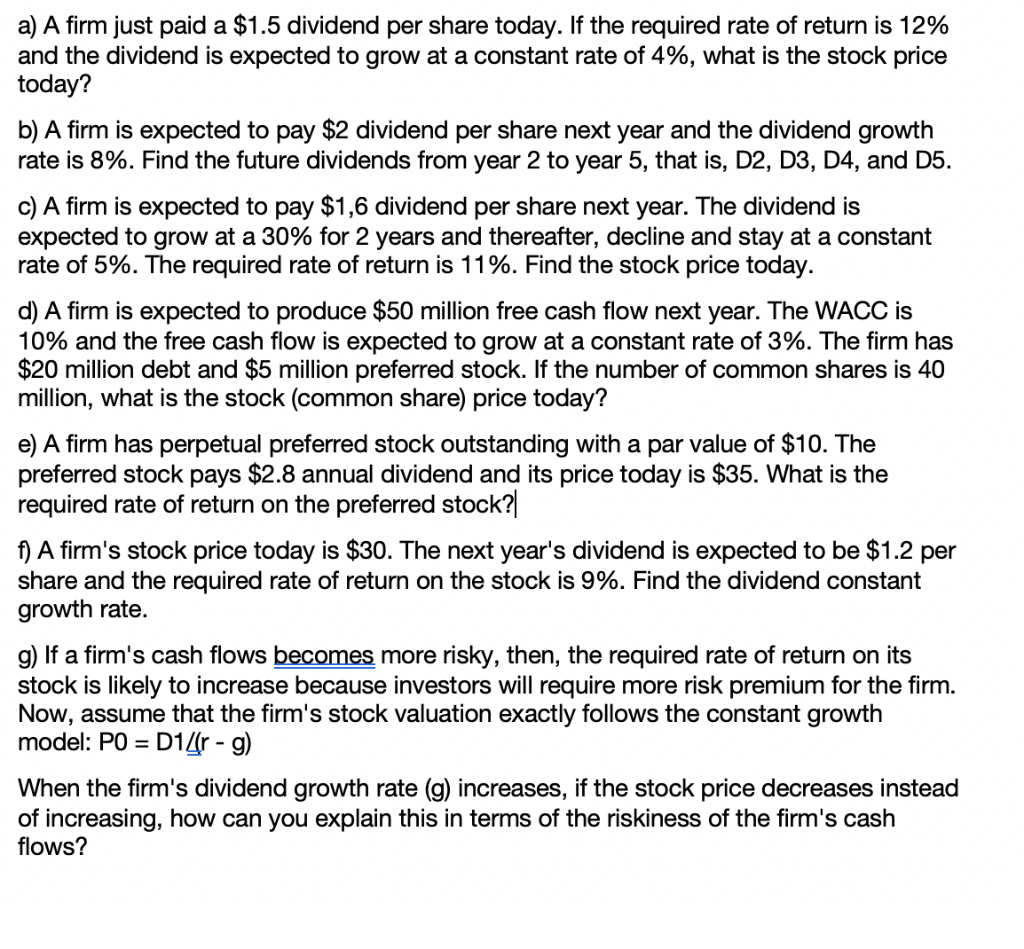

Solved a) A firm just paid a $1.5 dividend per share today.

Recomendado para você

-

Maps - Louyang, the Highland11 novembro 2024

-

Blog — Asheville Poverty Initiative11 novembro 2024

Blog — Asheville Poverty Initiative11 novembro 2024 -

Maps - Payon Forest11 novembro 2024

-

Maps - Veins, the Canyon Village11 novembro 2024

-

Maps - Comodo Kokomo Beach11 novembro 2024

-

Maps11 novembro 2024

-

Image of The Divine Comedy (La Divina Commedia, La Divine Comedie11 novembro 2024

Image of The Divine Comedy (La Divina Commedia, La Divine Comedie11 novembro 2024 -

Maps - Geffenia11 novembro 2024

-

The Divine Comedy by Dante Alighieri11 novembro 2024

The Divine Comedy by Dante Alighieri11 novembro 2024 -

UPD) ASTD Escanor Divine Pride(Peak) #astd #escanor #pride11 novembro 2024

você pode gostar

-

Demon Slayer Jigsaw Puzzle - Kyodai no Kizuna Version –11 novembro 2024

Demon Slayer Jigsaw Puzzle - Kyodai no Kizuna Version –11 novembro 2024 -

Pai Presente - Ton Carfi11 novembro 2024

Pai Presente - Ton Carfi11 novembro 2024 -

✨HURRY✨FRUIT BATTLEGROUNDS CODES - FRUIT BATTLEGROUNDS CODES 2023 - CODIGOS DE FRUIT BATTLEGROUNDS11 novembro 2024

✨HURRY✨FRUIT BATTLEGROUNDS CODES - FRUIT BATTLEGROUNDS CODES 2023 - CODIGOS DE FRUIT BATTLEGROUNDS11 novembro 2024 -

Black Summoner anime will start airing on July 9, 2022. (Studio: Satelight) : r/AnimeSociety77711 novembro 2024

Black Summoner anime will start airing on July 9, 2022. (Studio: Satelight) : r/AnimeSociety77711 novembro 2024 -

GIGACHAD NOOB, The fanon boss fights Wiki11 novembro 2024

GIGACHAD NOOB, The fanon boss fights Wiki11 novembro 2024 -

Play Anime Games Online - Star Trek Alien Domain, HISTORICA, RAN11 novembro 2024

Play Anime Games Online - Star Trek Alien Domain, HISTORICA, RAN11 novembro 2024 -

JCD — Ilustraciones por el episodio 72 de Shadowverse11 novembro 2024

JCD — Ilustraciones por el episodio 72 de Shadowverse11 novembro 2024 -

Big Pun - The Dream Shatterer (NX Remix)11 novembro 2024

Big Pun - The Dream Shatterer (NX Remix)11 novembro 2024 -

Camiseta Camp Half Blood Percy Jackson 100% Poliéster #2165 - R$ 25,0011 novembro 2024

Camiseta Camp Half Blood Percy Jackson 100% Poliéster #2165 - R$ 25,0011 novembro 2024 -

Console Sony Playstation 5 EA Sports FC24 Branco11 novembro 2024

Console Sony Playstation 5 EA Sports FC24 Branco11 novembro 2024